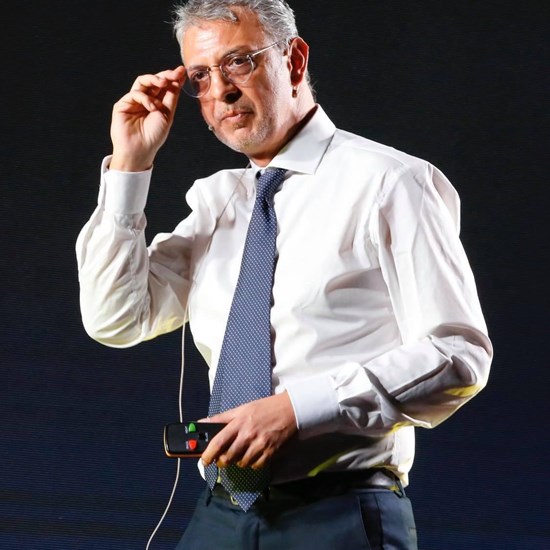

Last October, the Revenue Agency was called upon to express its opinion on mining activities. With the collaboration of Daniele Marinelli, the Ushare brand owner and the CEO of DTSocialize holding, let’s see what has been established.

Cryptocurrency mining: what it is and how it works

Mining can be a means of generating cryptocurrencies and a method for validating transactions made through cryptocurrency. In practice, we are not only talking about “extracting” cryptocurrencies but also about verifying the validity of cryptocurrency transactions that pass through the blockchain. Miners, with the support of technology, can solve complex mathematical problems and, in return, receive cryptocurrencies.

Specifically, they are reimbursed with the same cryptocurrency they have mined. It is, therefore, a lucrative activity, provided that the earnings exceed the costs of mining, which we know can be quite high. For example, in Bitcoin mining, the reward was 50 Bitcoin for each block, whereas today it is 6.24, and the number is expected to decrease further in 2024, dropping to 3.12.

Impact on direct taxes from mining

The Revenue Agency, in a statement, clarified for direct taxes that the remuneration from mining is included in the taxable base of the fiscal year, and the services are provided under the TUIR. Regarding the value of cryptocurrencies held at the end of each period, the difference between the initial tax value and the value recorded at the closing date of the tax period must be considered.

For IRAP purposes, on the other hand, miners’ earnings contribute to the formation of the net production value, making them revenue for service performance. The Revenue Agency has also analyzed the tax treatment that can be applied to mining activities for both direct and indirect taxes.

Mining must be treated outside the scope of VAT

What has been established, as concluded by the CEO of DTSocialize, is the impossibility of identifying the existence of a “customized” service performed by a miner for a beneficiary. This leads mining activities to be treated outside the scope of VAT, as there is a lack of reciprocity. The OECD has also expressed its opinion on this matter, noting that almost all countries consider transactions related to virtual currencies exempt or excluded from the scope of VAT. Similarly to what the Revenue Agency indicated, the absence of a reciprocal obligation for the benefit of a specific recipient implies that mining remuneration must be considered outside the scope of VAT.